Activision just announced its financial results for the fourth quarter of the calendar year 2018.

Unlike most other gaming corporations, Activision uses calendar years and not fiscal years in its reporting, so it’s pretty self-explanatory, related to the period between Oct. 1 and Dec. 31.

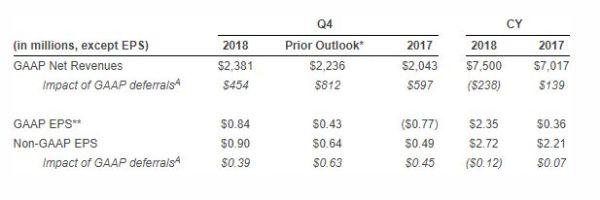

As you can see below, net revenues for the quarter were slightly above expectations and improved year-on-year. Results for the full calendar year 2018 were also higher than those recorded in 2017.

Activision Blizzard Chief Executive Officer Bobby Kotick accompanied the press release with a statement highlighting leadership changes to help the company reach its full potential.

“While our financial results for 2018 were the best in our history, we didn’t realize our full potential. To help us reach our full potential, we have made a number of important leadership changes.

These changes should enable us to achieve the many opportunities our industry affords us, especially with our powerful owned franchises, our strong commercial capabilities, our direct digital connections to hundreds of millions of players, and our extraordinarily talented employees.”

We also get a handy set of bullet points highlighting more details.

We hear that Call of Duty: Black Ops 4 sold more units to customers than Black Ops 3, with sales on PC more than tripled.

Full-game downloads were over 40% of the total, up from 30% recorded for WWII.

Spyro Reignited Trilogy’s launch is deemed “successful” and Crash Bandicoot N. Sane Trilogy shipped over ten million units.

Activision

- Activision had 53 million Monthly Active Users (MAUs) in the quarter, growing double-digits quarter-over-quarter. Fourth quarter segment revenues grew 6% year-over-year to $1.41 billion and operating income increased 14% year-over-year to $723 million.

- Call of Duty was again the number-one selling console franchise worldwide for the year, a franchise feat accomplished for nine of the last 10 years.1 In its launch quarter, Call of Duty: Black Ops 4 sold-through more units than Call of Duty: Black Ops III, with PC units more than tripling. Full-game downloads were over 40% of Call of Duty: Black Ops 4 console sell-through, versus approximately 30% for the prior release, Call of Duty: WWII.

- The successful launch of Spyro Reignited Trilogy in the fourth quarter and the ongoing contribution of Crash Bandicoot N. Sane Trilogy, which has sold-in over 10 million units since its 2017 release, highlight the enduring nature of Activision’s classic franchises.

Blizzard

- Blizzard had 35 million MAUs in the quarter, as Overwatch and Hearthstone saw sequential stability and World of Warcraft saw expected declines post-expansion-launch. Fourth quarter segment revenues grew 15% year-over-year to $686 million and operating income increased 51% year-over-year to $241 million.

- Building on an 11-year partnership, Blizzard extended its joint venture with NetEase to publish its games in China through January 2023.

King

- King had 268 million MAUs in the quarter, growing sequentially, driven by the successful launch of Candy Crush Friends Saga. Fourth quarter segment revenues grew 5% year-over-year to $543 million and operating income increased 28% year-over-year to $207 million.

- Candy Crush Friends Saga saw strong monetization and retention trends, contributing incremental growth for the Candy Crush franchise, which grew net bookings and MAUs year-over-year and quarter-over-quarter. This quarter, King had two of the top-10 highest-grossing titles in the U.S. mobile app stores for twenty-one quarters in a row, with Candy Crush Saga at #1 again.

- Advertising in the King network was again profitable with net bookings growing over 50% sequentially.

Interestingly, Blizzard also announces that it will increase investment in its biggest franchises “to accelerate the pace and quality of content for their communities and supporting a number of new product initiatives.”

This means that the cumulative number of developers working on Call of Duty, Candy Crush, Overwatch, Warcraft, Hearthstone, and Diablo will increase by 20% across 2019.

Conversely, Activision will “de-prioritize initiatives that are not meeting expectations and reduce certain non-development and administrative-related costs across the business.”